Not everyone can afford to buy a car, so the average Filipino has to work hard to get even a second-hand car. If people purchase a brand-new vehicle, it’ll be much more financially painful to lose the car in an auto accident. Insurance is the way to go to protect drivers from accidents, but many car owners are uninsured since they think that it’s only an additional expense that they won’t use.

Filipinos are also superstitious, and they think that getting insurance means inviting accidents to come. Many Filipino car owners thought they could make do without car insurance as long as they’re responsible drivers while forgetting that the Philippines’ roads are dangerous. There are also many irresponsible motorists on the road.

Accidents can happen anytime, and Parañaque car owners can lose their vehicles and pay for the damages themselves when they least expect it. Car insurance Parañaque can protect car owners from automobile accident costs, theft, and property damage. Thanks to the protection given by insurance plans, many people think that they’re costly.

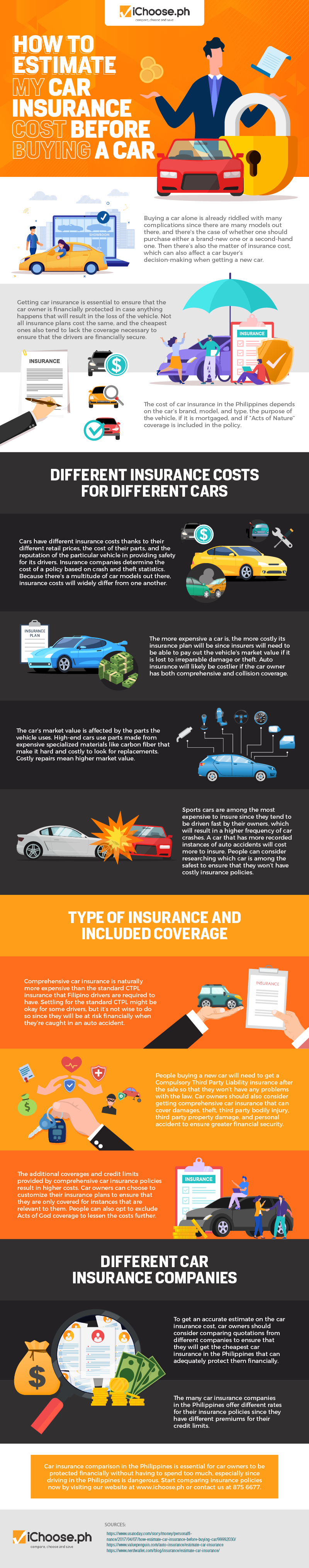

Many car owners don’t have comprehensive insurance plans because they think that the basic CTPL or Compulsory Third Party Liability insurance is enough to protect them. CTPL only covers liability, and it can’t protect the car owner themselves for any damages they sustain. People can get comprehensive car insurance to protect themselves at a relatively low cost if they know how to estimate its cost.

Filipinos can estimate how much they’ll pay for their insurance plans by checking out the car they want. An expensive vehicle will have higher insurance costs since their spare parts, and resulting repair jobs are costly. Insurers need to be able to pay for the car’s market value, so they’ll have to offer a plan with higher premiums.

The amount that people will have to pay for their car insurance also depends on the particular policy. Comprehensive insurance plans vary on their costs, depending on their inclusions. Some car owners may even be paying for coverage that they don’t need, so they must talk with their insurer to ensure that they’re covered only for the relevant risks.

The insurance company that the car owner will trust can also affect how much the insurance plan will cost. Comparing insurance plans in the Philippines allows car owners to get an affordable policy that meets their needs. For more information on comparing and estimating insurance costs before buying a car, see this infographic by iChoose.ph.