The use of cars has an undeniably profound impact on the world, particularly on people’s lives. The apparent change in people’s daily living is how it provided a transportation mode that could get them to places, whether for leisure or business purposes.

Today, many people buy a car to have the freedom to travel anywhere and anytime they like, and having one seems the norm these days; some even have more than one. It is also an excellent solution in avoiding the hassle and difficulty of commuting, whether going to school, office and even picking up groceries.

However, having a car entails getting in a vehicular accident, especially driving along Metro Manila, where vehicles’ volume exceeds cars’ space. Hence, the risk of accidents is high.

Furthermore, most car accidents happen on highways, but they may also occur on parking lots and street sides. Depending on the collision and other factors impacts the resulting injuries.

As such, many car owners have a comprehensive car insurance ph to protect them from financial ruin in case of an accident and help pay for injuries and the damages caused to someone else’s vehicle.

Unlike a life insurance ph, several states require drivers to have liability coverage at least. As a car owner, you can avail of additional coverage to add to your existing policy.

When it comes to paying for car insurance, it is essential to make payment time. Some insurance providers give their clients a grace period after missing a payment, which means a policy can stay active even without paying the premium yet.

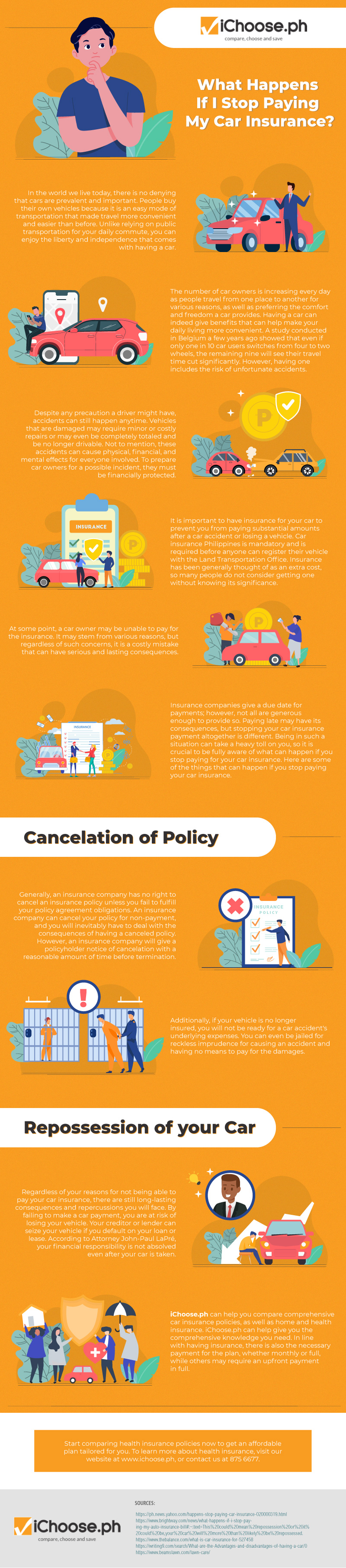

Some instances may arise, making the insured unable to pay for the car insurance premiums. A late payment is one thing: however, stopping to pay the car insurance can result in devastating consequences that can affect a car owner in the long run.

Click this infographic from iChoose.ph to learn some of the things that can happen if you stop paying for your car insurance.