There are different types of cards; one is a fragment of thick, stiff paper, thin pasteboard, or a small rectangular piece of plastic released by a financial institution. It is commonly utilized for writing or printing, while bank card usage is for payment to purchase goods and bills.

The earliest forms of handmade cards started in Ancient China. These found inventions in the 9th century during the Tang Dynasty that began in 618 up to 907. It was made for entertainment that the Tang Dynasty designated as the Collection of Miscellanea at Duyang. Princess Tongchang, daughter of the Emperor Yizong of Tang, described the deck of cards as the “leaf game” in 868 with members of the Wei clan, the family of the princess’ husband.

Before you know it, people are also employing cards as a mode of payment.

Financial institutions, commonly known as banks, are constituted to provide loans to the public. These firms became splendid assistance in the market while the economy is continuously growing, considering banks allow the broad masses to boost their credit and make a larger purchase – most especially those who inadequately need it.

Credit cards and debit cards are two examples of settlement.

The primitive debit card came out in early 1966 based on the Kansas City Federal Reserve’s documentation. The Bank of Delaware is the one who did the experimental basis of the plastic payment card. Soon enough, people perceive the advantages of owning a debit card can give. The snowballing number of consumers urged multiple banks to follow-through and established their own as more consumers try out the easiest way of settlement.

Before that, credit cards are the longest that existed before people used decrements. In the 1950s, Ralph Schneider and Frank McNamara established the Diners Club and fabricated the first cards.

These two bank cards simultaneously grew alongside the Digital Revolution and the Information Era amidst the 1980s. The knowledge of the human phase surpassed throughout the future periods. Numerous technologized human-made creations were quickly introduced to the masses by many geniuses. One of those innovations is the Automated Teller Machines (ATMs) that any person could go to withdraw cash and swipe bank cards to make a payment.

So, what makes debit and credit card different from each other?

Debit cards concede an individual to disburse money by depositing funds through the bank. It is much easier to apply for these credentials since it is instantly direct to a checking account. There won’t be any amassing card bills and ensured interest charges.

On the contrary, credit cards allow a person to borrow money from the card emitter to a specific limit to purchase desired products or services or withdraw cash. These are the most complicated to obtain. Banks have particular qualifications for a perfectly suitable individual and without a credit history and clean loan history.

Despite the difficulty in owning a credit card, there are multiple benefits that a person can retrieve. Once a credit card holder is a good payer, there will be one-time bonuses, cash backs, and reward points; it will be easier to evade losses from any frauds. There are grace periods before the money is credited. A person can utilize it everywhere because it is accepted universally. Of course, it builds up credit.

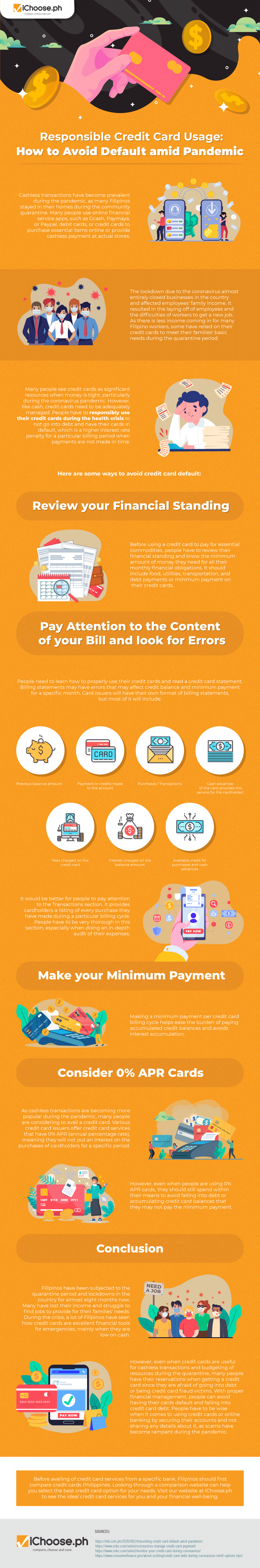

However, credit cards can also be a massive drawback when the holder is not responsible enough with its usage – particularly during the COVID-19 pandemic when some workforces are on hold.

Thus, iChoose.ph, a known health insurance PH and life insurance company, created and designed an infographic on how to be a responsible credit card user amid pandemic: